Occam’s – Financial Support of Adult Children and Your Retirement

Much has been written about how the current generation of young people are transitioning to full adulthood. Some take a very negative view, characterizing the transition as “slow,” while others take a sympathetic view, reasoning that the transition is more difficult to make than it was for prior generations, given that the cost of education and housing have both grown faster than inflation over the past several decades. Without passing judgment one way or the other, it is worth recognizing that the transition to full adulthood has changed.

Becoming an Adult

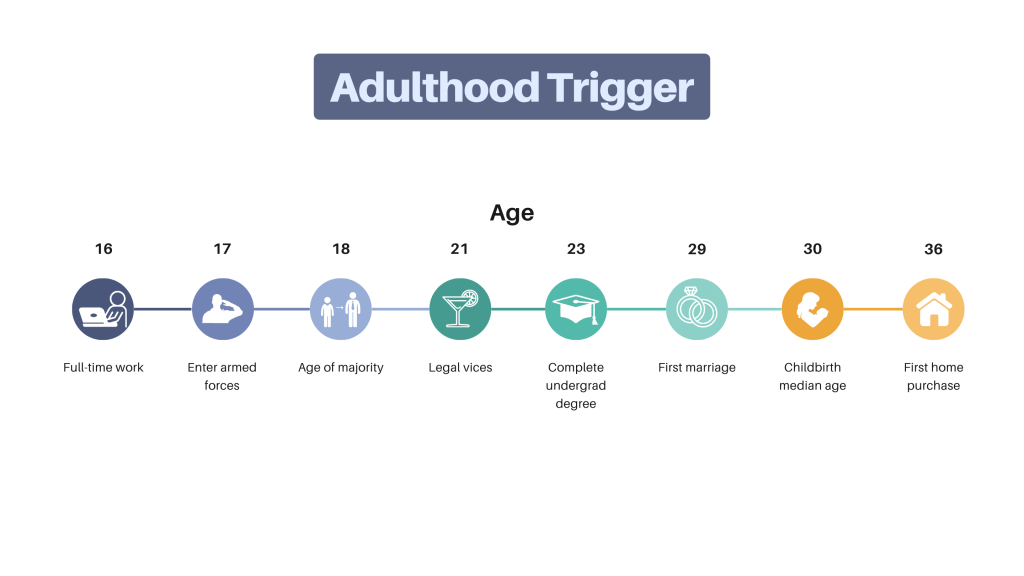

Let’s start by examining some of the traditional milestones to full adulthood and the changes that have occurred. Starting at age 16, in most states, people can work full-time, individuals are able to enter the armed forces at age 17, be prosecuted as an adult at 18 years old, and, at age 21, they can drink, smoke, and gamble. These “legally defined” milestones to adulthood have remained relatively constant in the recent past. However, when we examine traditional adulthood milestones of choice, we see a different pattern emerge. For example, more young people are deciding to pursue advanced education and finishing their formal education at ages later than ever before. Notwithstanding this older age of completing their education, fewer people are getting married shortly after completing their education. Young people are delaying marriage until age 29 on average, and although not always tied to marriage anymore, young people are delaying childbirth. In fact, the median age of childbirth is at an all-time high of age 30 based on the declining fertility of young people and the increasing fertility of older people. Finally, it can be observed that young people are putting off homeownership as the average age of first home purchase recently reached an all-time historical high, age 36.

Indeed, the once seemingly quick transition from adolescence to adulthood is giving way to a whole new life stage of young adulthood. Because of this, a question may present itself to parents of children in their 20s: To what extent are parents expected to provide financial support to adult children during these years? Of course, at birth, children are completely dependent on their parents, and through decades of parenthood, parents are naturally conditioned to be supportive and desire to support their children in finding their way in the world. But what are the financial consequences to your retirement and other financial goals that might be associated with funding another decade of life for our adult children, and what is the right thing to do for them?

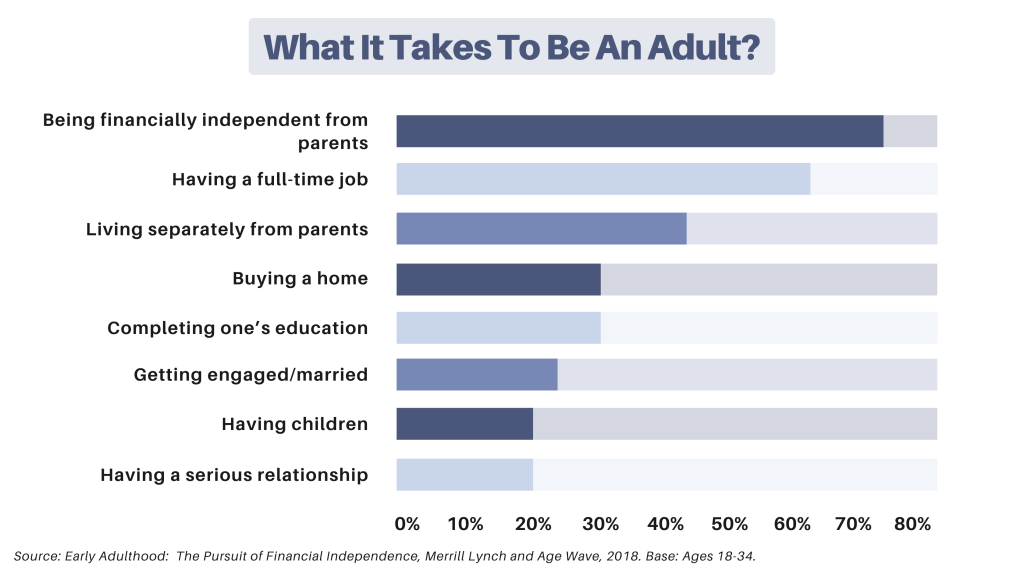

When early adults are asked what they believe is important to becoming an adult, their answers include the traditional milestones addressed above. However, the most commonly cited requirement of what it takes to be an adult is “being financially independent from parents”. It’s certainly worth noting that in attempting to help adult children, we may actually hold them back from feeling like adults.

How Widespread and How Impactful?

Many parents, without any real thought process or analysis, find themselves providing financial support to their adult children. Not only is the type and nature of the financial support not clearly established, but the impact on their own retirement is often completely ignored. Indeed, research shows that nearly 7 in 10 parents of adult children have provided financial support, and roughly half say that this support impacts other financial goals in their lives, with approximately 20% indicating that the impact was significant.

Parents of virtually all income and ethnic groups provide financial support to their adult children. The prevalence of this practice was uncovered in a study of the macro impact of financial support for adult children of the macro impact of financial support for adult children. This study found that parents of adult children were providing twice as much money to their adult children than they were electing to put away toward their own retirement. One of the hidden drivers of the retirement savings crisis in America is … financial support for adult children!

I believe there is a better approach. This approach gives parents a straightforward framework for decision-making to thoughtfully analyze the topic of financial support for their adult children and its impact on their own retirement.

Consider Circumstances First

Part of the challenge today is that the first question many parents find themselves asking is, which expenses should we cover for our adult children? However, I think they should reframe the issue and ask a different question first. Specifically, what are the circumstances under which we might be willing to provide financial support to our adult children?

In my experience, there are seven circumstances that are worth considering. While there can be some overlap, thinking about each of these circumstances discreetly will help clarify the way forward for parents. Ask yourself, under which of the following circumstances might you be willing to provide financial support to your adult children?

Circumstance #1 True Financial Dependence

True financial dependence occurs when a child is not capable of independently providing a financially secure future for themselves due to a permanent disability or condition such as autism. Parents of truly financially dependent children recognize this well before their child enters young adulthood and are wise to seek professional guidance on how to set up special needs trusts and determine if they are eligible for any government benefit programs such as Social Security Disability Insurance to ensure some measure of lifelong financial security for their child. For parents of children in this situation, this is often one of the most important drivers of their financial planning.

Circumstance #2 Recovery Safety Net

When an adult child experiences a significant, unexpected financial shock, the young adult may need financial support. This could be the result of a sudden job loss, a serious health emergency, divorce, or financial fraud. Although these incidents are, unfortunately, far too common, few young adults adequately plan for them and may not yet have built sufficient resources to weather the incident. In these circumstances, parents may want to provide financial support until their child is able to regain their financial footing.

Circumstance #3 Investment in the Future

Many parents believe that it’s worth paying for expenses that will improve the financial future of their adult children. A common example is parents who pay for a portion of their child’s college education. Within this category, parents may want to consider what portion of expenses they’re willing to pay i.e., is the child co-invested with the parents by putting some of their own money toward this investment in their future? In addition, parents may need to ask if there are any limits or qualifications that they want to put on their investments in their child’s future. For example, are there only certain degrees worth subsidizing? Is there a limit to the number of degrees (advanced or otherwise) that parents are willing to financially support? Other instances that may fall within this circumstance might be financial support of a business opportunity.

Circumstance #4 Building a Financial Foundation

This circumstance often occurs when the child finishes their formal education but before the formation of their own family. This can come in the form of indirect financial support. For example, allowing a child to live at home for free enables the child to build their financial foundation more quickly than they otherwise could.

Circumstance #5 Living Beyond Their Means

In this circumstance parents provide financial support in ways that enable their adult child to live a lifestyle that they could otherwise not afford. For example, parents may subsidize or fully pay rent for an apartment that would otherwise be unaffordable for their adult child. Parents may pay for other expenses, sometimes indirectly, for example, by giving an adult child a car. Frequently, this financial support can be perceived as necessary to keep their child safe and/or helping them keep up with their child’s peer group. Covering any basic living or lifestyle expenses generally falls into this circumstance.

Circumstance #6 Inertia

In this circumstance parents don’t want to bother making the changes necessary to separate their adult child from their ongoing expenses and so things are kept the way they have always been. Common instances include the family Netflix account, the family’s mobile phone plan or even auto insurance.

Circumstance #7 Personal Benefit/Influence

The last circumstance can be hard for parents to admit to themselves. In this case, parents provide financial support to their adult child because it gives them some personal benefit or influence in their child’s life that they may not otherwise have. In my experience, this is not necessarily ill-intentioned. Afterall, what’s wrong with an extended family vacation together, anyway? But the financial support is not because of financial need, which often means the parents are effectively purchasing a benefit. In some cases, this dynamic can be ill-intentioned such as with a meddling (but financially generous) father/mother-in-law who buys family access or influence that might otherwise not be welcomed or tolerated.

So, step one for parents is not to ask what to pay for, instead, ask when to provide financial support, under which circumstances?

Financial Support and Type of Impact on Retirement

Once you decide under which circumstances you’re willing to consider providing financial support to your adult children, you can then focus on the type of impact on your retirement you are willing to accept. Financial support generally falls into three categories: 1) Detrimental to your retirement preparedness, 2) Neutral to your retirement preparedness, or 3) Beneficial to your retirement preparedness. Let’s examine each one of these.

Type #1 Detrimental to Retirement Preparedness

In most instances, providing financial support to your adult child will impair your ability to retire. Every dollar of support you provide to your adult child is one less dollar that is not available for your retirement. This is by far the most common situation.

Type #2 Neutral to Retirement Preparedness

There are some limited circumstances in which providing financial benefit to your adult child does not have any cost to you and thus has no impact on your retirement preparedness. This may be the case if you have a “family” insurance plan to cover you and your spouse, and there is no additional cost to include children on the health insurance plan (up to age 26). Some subscription services that are not per-person-based may fall into this category as well.

Type #3 Beneficial to Retirement Preparedness

Finally, the third type of impact can be a win-win relationship. This can occur, for example, when the adult child lives in the home of the parent and pays some amount of rent and/or helps with the cost of utilities. Assuming the parents were going to be living in the same home regardless, this can be a financial gain for both the adult child and the parent.

Once parents decide under which circumstances they are willing to provide financial support, they need to think about what type of support they will provide. This can, and often does, vary by circumstance. A question some parents may struggle with is whether they have to follow the same set of “rules” for all their children, or can they have a different approach with each of their children? This is, of course, an entirely personal decision based on what parents view as “fair”. The comfort with taking different approaches among their children is often made easier if the differences in life circumstances of their children are significant. For example, few would have a problem with a parent providing a different level of financial support to a child who is financially dependent vs. a child who is not. However, if life circumstances are more similar than different, it can be more difficult, but not impossible, to apply different approaches. Finally, these decisions are not “set and forget.” They can change over time as parents re-evaluate changing circumstances.

Terminating Financial Support

The next step in the process is to address how long the financial support will be provided. In my experience, this step is almost always overlooked even though it is critically important to create a mutual understanding of the terms of financial support. In practice there are three termination triggers typically used 1) None (indefinite), 2) Time-based triggers, and 3) Situation-based triggers.

Termination Trigger #1 None

When no defined trigger exists that will end financial support, the recipient makes the implicit assumption that the support will be provided “for the foreseeable future”. This can often lead to resentment by the parents and frequently results in a rather abrupt end of support, often coming as a near-total surprise to the recipient – and thus instilling resentment in the adult child. This is far from an ideal situation for both the provider and the receiver of financial support. Unfortunately, this is the default situation and by far the most common arrangement.

Termination Trigger #2 Time-based

With a time-based duration trigger, the provider and recipient have a clear and shared understanding of when the financial support will terminate, e.g., in 6 months, in a year, or some other specific timeframe. Incidentally, “forever” can be a valid duration if it is sustainable, agreed upon, and clearly discussed. Time-based duration triggers can be extended if the circumstances demand it, but one needs to be careful of “auto-extending” the support without thought or discussion.

Termination Trigger #3 Situation-based

With a situation-based trigger, the financial support terminates upon an agreed-upon event taking place. Triggers can be from various aspects of life. For example, a professional trigger could be when the adult child receives a promotion or a raise. Age-based triggers are common for certain types of support, such as health insurance. Financial triggers also exist, for example, making the final payment on student debt. A trigger can include anything that is observable, objective, and agreed upon by you and your child.

Quantifying Total Financial Support & Making Assessment

Finally, parents can do some rough calculations to get a clearer sense of the magnitude of the financial support they are willing to provide to their adult children. The financial support to adult children will typically be divided into two buckets. One bucket includes an amount that is fully expected to be spent. A portion of college tuition, for example. The other bucket includes a reserve fund. For example, parents might put aside an amount that they would provide to their adult child as a recovery safety net. As their child becomes more financially secure and develops their own rainy day fund, the parents can decrease the amount they have in reserve for their child until, eventually, they can reduce this contingent amount to zero.

For parents willing to provide financial support in only a limited number of circumstances and/or have a small number of children, the amount given to their adult children may have a manageable impact on their future retirement financial security. However, for those parents who intend to provide financial support across a broad set of circumstances and/or have many children, they may find themselves surprised at the total amount they may be committing to fund their adult children. This may cause them to rethink their decisions and/or their retirement plan and strive to create better alignment with their desire to support their adult children and their desire to live a financially secure retirement. In any case, it is better to make a thoughtful, informed decision regarding support for adult children and its impact on your retirement.

McLean Asset Management Corporation (MAMC) is a SEC registered investment adviser. The content of this publication reflects the views of McLean Asset Management Corporation (MAMC) and sources deemed by MAMC to be reliable. There are many different interpretations of investment statistics and many different ideas about how to best use them. Past performance is not indicative of future performance. The information provided is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy or sell securities. There are no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information on this presentation. Indexes are not available for direct investment. All investments involve risk.

The information throughout this presentation, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission there of to the user. MAMC only transacts business in states where it is properly registered, or excluded or exempted from registration requirements. It does not provide tax, legal, or accounting advice. The information contained in this presentation does not take into account your particular investment objectives, financial situation, or needs, and you should, in considering this material, discuss your individual circumstances with professionals in those areas before making any decisions.