Overweighting US Stocks in Your Portfolio

Investing is deceptively simple. Until it’s not.

As investors, we want to start with the market portfolio—that is, by definition, the most efficient portfolio. But we’ll also want to customize our investments to address our specific situation.

For instance, the global bond market is substantially bigger than the global stock market, but most retirement-focused investors’ portfolios are more heavily tilted toward stocks than bonds. There are all sorts of reasons for this (some better than others).

But the basic fact is that we (and you, specifically) are different from the average investor. And that means that we want to tilt our portfolio away from the market in certain ways.

You Aren’t Average

One of the biggest ways that you are different from the average investor is that you live in America. The financial markets may be global, but individuals aren’t. So our portfolios need to account for that. We’ll want our investments to tilt towards, or overweight, the US relative to the market portfolio. In other words, we want a home bias.

There are 3 big reasons that we want this home bias:

- We do our spending (almost exclusively) in US Dollars

- Local investors might be treated better than us in their home country

- We are tied to the US economy

Let’s break these down.

First, living in the US means that our entire financial lives are denominated in US Dollars. Anytime we bring foreign currencies into the mix, whether it’s spending or investment, we’re taking on some degree of foreign currency risk. And foreign currency risk has no associated expected return. It’s just extra uncertainty.

This isn’t a particularly big deal when you go on vacation, and the price of souvenirs might be a little higher (or lower) than you expected, but it’s a different story with your investments. Normally, we discuss the issues around foreign currency risk with regard to your bonds, but it’s also an issue with your stocks (just not quite as big of one). that they need to overcome.

Additionally, there is the potential that we might not be treated as well as local investors in certain circumstances. Depending on the country, non-local investors (us) might end up paying higher effective tax rates or having to deal with capital controls that prevent us from getting our money out when we want it. On a practical level, investing outside the US just tends to be a little more expensive.

Finally, living in the US means we are simply tied to the US economy. We are social creatures – we care about how we are doing relative to the people around us. Whether we want to call it next-door neighbor risk, keeping up with the Joneses, or FOMO, if everyone around us overweights US investments (and oh boy, they do), we can make our life better by following suit. Because we’re also loss-averse, we will care more about the times that everyone else’s portfolios beat us than the other way around.

Even in more objective terms, our spending is going to be tied to the fortunes of the US economy. When the US economy is doing well, you will probably spend more, so you want your investment portfolio to reflect this.

For these and other reasons, investors tend to overweight their home countries. The trick is figuring out what “overweight” means here.

The Weight of the World’s Stock Markets

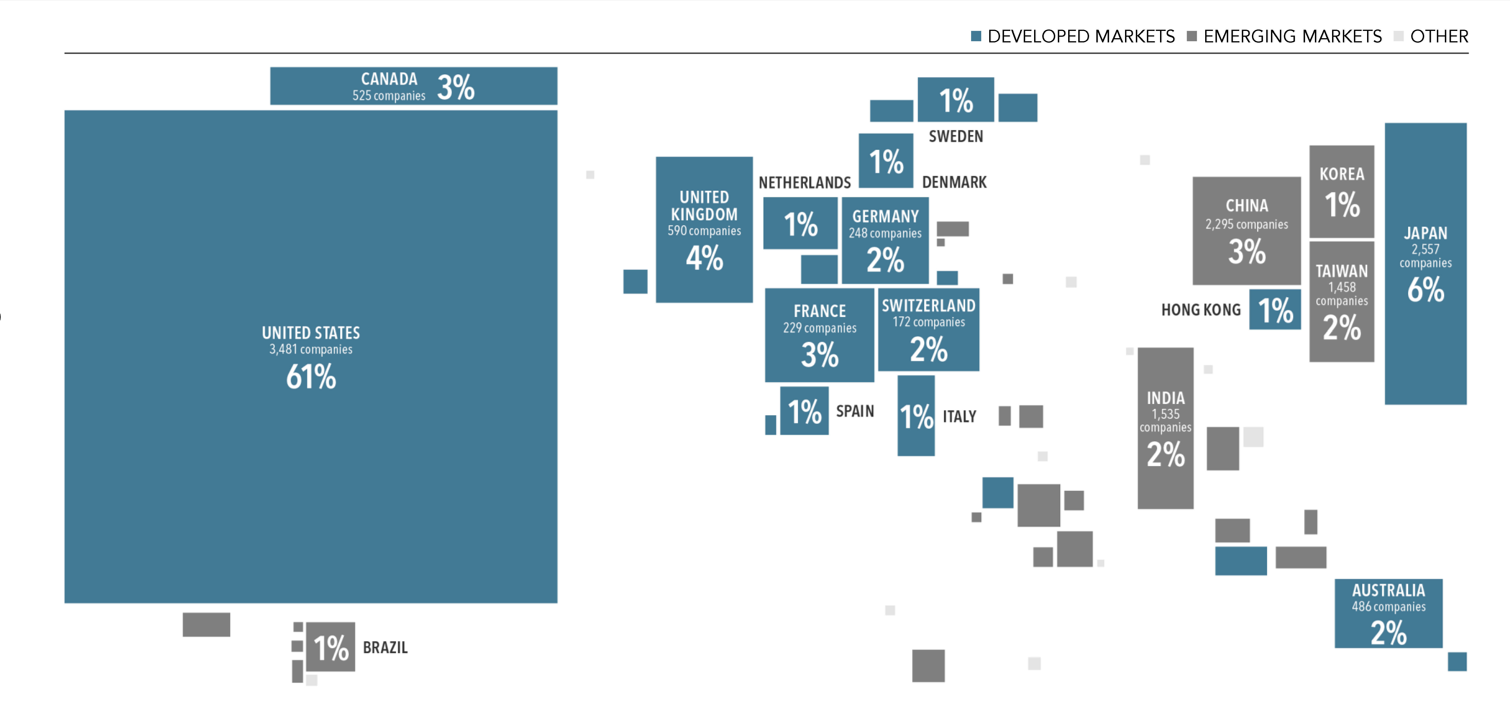

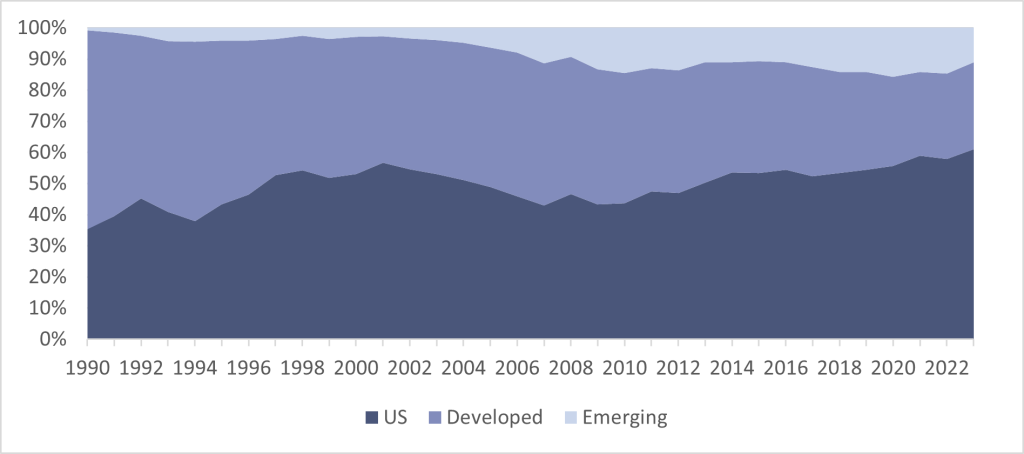

Currently, the US stock market represents 61% of the value of stocks across the world (Japan is the next biggest country at 6%, and then the UK at 4% as points of comparison).

And the US has been creeping up over the past couple of years (along with the Emerging Markets).

Since the late 1990s, people have been able to say that the US has (very) roughly represented around half of the world market cap and built their allocations around that.

Cutting Your Portfolio on the (Home) Bias

The big question remains, though. We know that we probably want some degree of home bias, and we know where the market is, but what should our allocation look like?

The first thing we need to consider is whether the US outperformance is the random part of the random walk. There’s no particular reason to believe that stocks have a higher expected return - put differently, there’s no reason to believe that US companies are riskier than non-US companies.

But if there is no difference in expected returns, does that mean that non-US stocks will outperform the US to “make up” for the US doing so well over the past few years? Not necessarily. The markets are always looking forward. It doesn’t matter how we got where we are, only what’s coming next. Markets move based on new information, and specifically how that new information squares with what investors expected to happen next.

So where does that leave us?

Well, it leaves us in the same place most asset allocation decisions leave us – balancing a bunch of competing demands on our portfolio. In this case, the two big ones are our desire for our portfolio to overweight US stocks while at the same time not losing out on participating in the global stock market – both in terms of the benefits of international diversification, as well as wanting to be able to take part in the global economy.

And, one of the big complications is that because the US represents such a massive proportion of the global stock market, it’s hard to materially overweight US stocks without losing out on the diversification benefit from international investing. Everywhere else in the world, it’s incredibly easy to have a significant home bias without compromising your global coverage (Australians may take this a bit far, though – but my understanding is they are getting better).

However, America’s weighting means that the large degree of home bias that we see in other countries – investors often overweight their home country by multiple times their weight in the global market – isn’t as necessary in the US (even if it was mathematically possible). Because our portfolios are already dominated by the US economy and the US Dollar, even in a market-weighted portfolio, we don’t need to push as hard to get the benefits of a home bias.

That being said, there is no magic number or range of numbers to tell us the “right” allocation. It comes down to personal preference and what you feel comfortable with. What matters is finding the portfolio that will let you stay disciplined and keep you aligned with your long-term retirement portfolio (no matter what your neighbor is saying about their portfolio).

McLean Asset Management Corporation (MAMC) is a SEC registered investment adviser. The content of this publication reflects the views of McLean Asset Management Corporation (MAMC) and sources deemed by MAMC to be reliable. There are many different interpretations of investment statistics and many different ideas about how to best use them. Past performance is not indicative of future performance. The information provided is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy or sell securities. There are no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information on this presentation. Indexes are not available for direct investment. All investments involve risk.

The information throughout this presentation, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission there of to the user. MAMC only transacts business in states where it is properly registered, or excluded or exempted from registration requirements. It does not provide tax, legal, or accounting advice. The information contained in this presentation does not take into account your particular investment objectives, financial situation, or needs, and you should, in considering this material, discuss your individual circumstances with professionals in those areas before making any decisions.